Electric vehicles (EVs) have long been positioned as a key instrument in national decarbonization strategies, as they generate no direct greenhouse gas emissions during operation. As countries continue to strengthen their Nationally Determined Contributions (NDCs), electrification remains a core element of medium- to long-term policy frameworks. South Korea’s target to reduce greenhouse gas emissions by 53–61% from 2018 levels by 2035 clearly reflects its policy direction toward accelerating electrification in the transport sector.

However, South Korea’s EV market has faced near-term pressure since the start of 2025. A combination of reduced purchase subsidies, safety-related concerns, and regional disparities in charging infrastructure has weighed on consumer sentiment, resulting in EV demand falling short of expectations. In response, policy efforts are shifting away from single-point purchase incentives toward mechanisms aimed at easing cost burdens throughout the entire EV transition process.

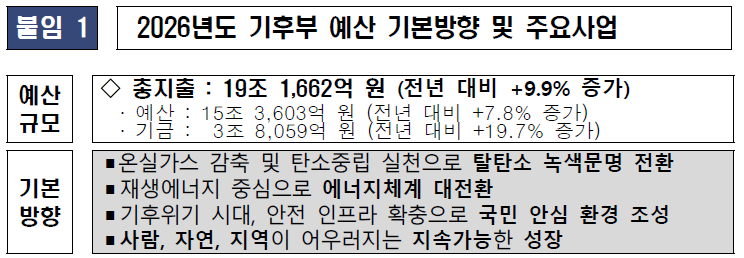

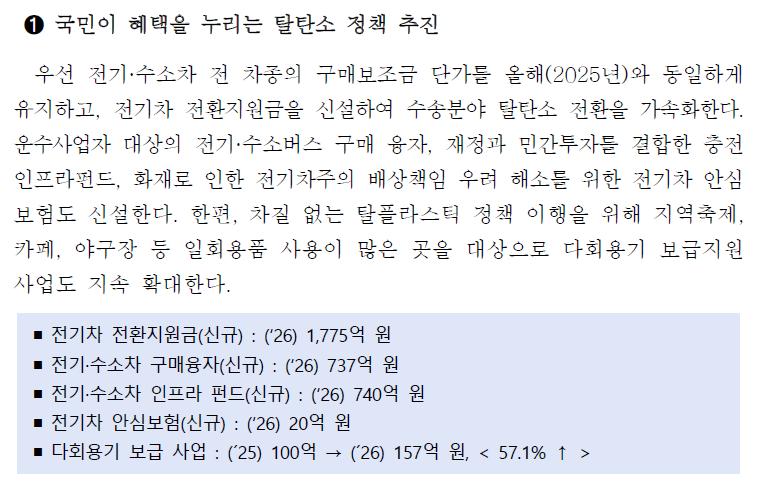

2026 Total Budget of the Ministry of Korean Climate and Energy and Environment (left), EV-related Support Budget (right)

Source: Korean Ministry of Climate, Energy and Environment

According to the 2026 climate and energy budget proposal released on the 8th, related spending will increase by 7.8% year-on-year to KRW 15.36 trillion. A newly introduced “EV transition incentive” will provide additional subsidies of up to KRW 1 million for consumers replacing internal combustion engine vehicles with EVs, supported by a budget of KRW 177.5 billion. In addition, a separate “EV safety insurance” program has been included to help address heightened safety concerns following recent EV fire incidents.

At the same time, the expansion of the carbon credit scheme to individual EV users has emerged as another key policy development. The government has recently revised the methodology for external projects under the emissions trading system, allowing greenhouse gas reductions achieved through personal EV usage to be recognized as eligible carbon credits. Previously, the scheme largely applied to electric buses, taxis, and corporate fleets.

Carbon credits represent the right to emit a certain amount of greenhouse gases within a capped system and are traded through South Korea’s exchange market. Current prices range from the high KRW 9,000s to the mid-KRW 10,000s per ton, suggesting that the immediate financial benefit for individual consumers remains limited. However, compared with major international carbon markets, domestic prices remain relatively low, leaving room for future price fluctuations as emissions targets tighten and the system evolves.

A key feature of the revised scheme is that it is not a one-off subsidy, but rather a mechanism that allows incentives to accumulate over the vehicle’s ownership and usage period. Authorities are reportedly reviewing multiple reward formats, including cash payments, point-based incentives, and tax credits. The scheme is expected to be implemented in the second half of 2026, with the first payouts likely in the second half of 2027, based on annual driving records.

Overall, a sharp rebound in the EV market is unlikely in the near term, as structural challenges related to demand recovery, safety perceptions, and charging infrastructure expansion persist. Nevertheless, as more affordable EV models are introduced, charging conditions continue to improve, and transition incentives and carbon credit schemes are gradually implemented, EV demand is expected to enter a phase of gradual recovery.

Looking ahead, growth in South Korea’s EV market is likely to be driven less by short-term subsidies and more by policy continuity, declining usage costs, and tangible benefits perceived by consumers during actual vehicle operation. Under these conditions, the market is expected to follow a steady and orderly growth trajectory.